Complexity and Responsibility: Using an SDIRA, you have got more Management around your investments, but In addition, you bear extra responsibility.

As an investor, nonetheless, your options will not be restricted to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can rework your portfolio.

Entrust can aid you in buying alternative investments with your retirement cash, and administer the acquiring and marketing of assets that are typically unavailable through banking companies and brokerage firms.

A self-directed IRA can be an extremely highly effective investment vehicle, nonetheless it’s not for everybody. As the declaring goes: with terrific energy comes excellent duty; and using an SDIRA, that couldn’t be far more legitimate. Continue reading to master why an SDIRA might, or won't, be for yourself.

IRAs held at banks and brokerage firms offer limited investment options for their consumers as they don't have the experience or infrastructure to administer alternative assets.

The principle SDIRA policies in the IRS that traders have to have to understand are investment limits, disqualified people, and prohibited transactions. Account holders have to abide by SDIRA principles and regulations so that you can protect the tax-advantaged position of their account.

Range of Investment Solutions: Ensure the service provider allows the types of alternative investments you’re considering, like housing, precious metals, or private equity.

Generating quite possibly the most of tax-advantaged accounts allows you to maintain a lot more of The cash you spend and receive. Based upon whether or not you choose a standard self-directed IRA or maybe a self-directed Roth IRA, you may have the likely for tax-no cost or tax-deferred expansion, presented particular conditions are fulfilled.

Limited Liquidity: Many of the alternative assets that may be held in an SDIRA, including real-estate, private equity, or precious metals, may not be easily liquidated. This may be a difficulty if you might want to obtain resources immediately.

Housing is among the most popular choices among SDIRA holders. That’s because you can put money into any type of housing which has a self-directed IRA.

At times, the my site expenses affiliated with SDIRAs can be greater and even more challenging than with an everyday IRA. It's because with the increased complexity related to administering the account.

Once you’ve found an SDIRA service provider and opened your account, you could be pondering how to actually start investing. Being familiar with both of those The principles that govern SDIRAs, in addition to how to fund your account, may also help to lay the muse for the future of thriving investing.

Numerous investors are stunned to know that using retirement funds to take a position in alternative assets has been achievable due to the fact 1974. Nevertheless, most brokerage firms and banking institutions give attention to presenting publicly traded securities, like shares and bonds, mainly because they deficiency the infrastructure and know-how to deal with privately held assets, such as real estate or non-public fairness.

SDIRAs will often be used by palms-on investors who are prepared to tackle the pitfalls and obligations of choosing and vetting their investments. Self directed IRA accounts can even be perfect for buyers which have specialised knowledge in a distinct segment market which they would want to spend money on.

Assume your Mate could possibly be starting up the following Fb or Uber? By having an SDIRA, it is possible to invest in causes that you think in; and probably appreciate bigger returns.

No matter if you’re a financial advisor, investment issuer, or other financial Experienced, check out how SDIRAs can become a powerful asset to develop your enterprise and achieve your Qualified objectives.

Shopper Guidance: Try to find a company that gives dedicated guidance, which includes usage of proficient specialists who can remedy questions about compliance and IRS regulations.

An SDIRA custodian differs as they have the right team, experience, and capability to maintain custody from the alternative investments. The first step in opening a self-directed IRA is to find a service provider that is specialised in administering accounts for alternative investments.

Certainly, housing is among our consumers’ hottest investments, at times referred to as a property IRA. Clients have the choice to take a position in every thing from rental properties, business real-estate, undeveloped land, home loan notes plus much more.

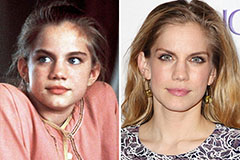

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!